6 Mistakes Foreigners Make While Taking a Mortgage in Germany

- GermanPedia

- Jul 12, 2022

- 6 min read

Save money by being aware of the six simple things about mortgages in Germany.

You are taking a mortgage to buy a house in Germany. You have researched and contacted several banks to get the best offer possible. But, you still have doubts about which offer to take.

You are spending loads of money to buy your dream house. And, you want to save money in any way possible.

Don't worry; I am here to help. You can save thousands of euros by avoiding the following six mistakes while taking a mortgage in Germany.

1. Not checking the effective interest of the loan

In Germany, there are two types of interest rates while taking a mortgage.

Sollzins (Borrowing rate): It is the interest rate that the bank charge for issuing a loan to the borrower.

Effektivzins (Effective interest rate): It is the sum of the "Borrowing Rate" and other costs that the bank may incur, like "property appraisal cost," "transaction cost," etc.

As you may guess, the effective interest rate is more than the borrowing rate. And you pay the effective interest rate on your loan.

Many times bank consultants tell the borrowing rate while making an offer.

Unfortunately, many foreigners do not know the difference between borrowing and effective interest rates. Hence, they do not ask the bank about it while discussing the mortgage offer.

As a result, they miss out on the best mortgage offer they could get.

What should you do instead?

Always ask banks about the effective interest rate of the loan.

Compare the mortgage offers against the effective interest rate (Effektivzins) instead of the borrowing rate (Sollzins)

2. Ignoring how the banks in Germany calculate the mortgage interest

Math is not the strong suit of many. Banks take advantage of this fact. They use different methods of calculating interest to squeeze the most money out of you.

Here are two common ways of calculating mortgage interest.

Method 1: Banks calculate interest on decreasing principal

In this method, the bank calculates the interest on the loan amount left. As you repay the mortgage, the principal will reduce. With the decrease in the "principal," the "interest" will also decrease.

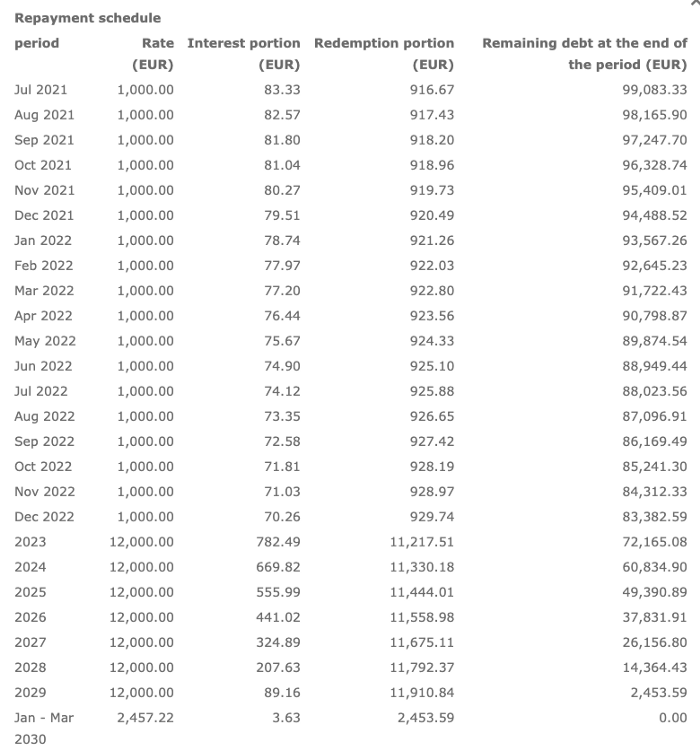

For example, you took a mortgage of 100k € at 1% interest. And, your monthly installment is 1000 €. So, in the beginning, 916 € will be the "principal" and 84 € the "interest" part of your monthly installment.

As you can see in the image, the interest portion of the installment is decreasing with time.

In this method, you will pay 4457 € in interest over time.

Method 2: Banks calculate interest on the fixed principal

In this method, banks calculate the interest on the original loan amount for the entire mortgage term.

Continuing with the same example, the "interest" part of the monthly installment will remain at 84 € throughout the loan term.

In this case, you will pay 9072 € in interest over time—more than twice what you paid in method 1.

| Method 1 | Method 2 |

|---|---|---|

Mortgage | 100k € | 100k € |

Interest Rate | 1% | 1% |

Monthly installment | 1000 € | 1000 € |

The principal part of the installment | 916 € (Increases with time) | 916 € (Fixed the entire term) |

The interest part of the installment | 84 € (Decreases with time) | 84 € (Fixed the entire term) |

Total interest paid over time | 4457 € | 9072 € |

What should you do instead?

Always confirm how the bank is calculating the interest on your mortgage. To keep things simple, ask your bank consultant to provide you with one of the following.

The total interest you will pay by the end of the mortgage.

The repayment schedule of your mortgage. The repayment schedule looks like image 1.

Once equipped with this information, you can compare the mortgage offers better.

3. Relying on mortgage brokers to get loans in Germany

Many foreigners rely on mortgage brokers to get a mortgage in Germany.

As the name suggests, brokers are the middlemen between you and the bank. They look for different offers in their system based on your profile.

But, a broker does not have the authority to approve the loan offer. Only a bank can approve it. Thus, there is a risk that you do not get the promised mortgage offer.

Many expats and locals have had bad experiences with mortgage brokers in Germany. One of them is that the broker changed the original mortgage offer at the last moment.

What can you do about it?

You should discuss offers with the brokers but never rely on them. Instead, contact different banks directly to have more reliable offers.

If a broker can get you a better offer, go for it. If not, you have other options available.

In short, it's an open market. So go out and shop around to find the best mortgage offer.

💡 NOTE: Few banks or brokers may reject your loan application but, others may accept it. So, do not lose heart, if the first bank or broker said you cannot get the credit. There are many more who would be happy to lend you money.

4. Taking mortgage insurance

There are different types of insurance that you can take to protect yourself and the lender in case of unfortunate events.

For example, paying the mortgage if the borrower dies, loses their job, or cannot continue their employment.

Like any other insurance, you must pay a monthly premium throughout your loan term. Which further adds to your cost of buying a house in Germany.

The good news is that taking such insurance is optional.

However, few banks may make it mandatory for you to take them. Moreover, some bank consultants may even try to sell such insurance and schemes to you.

Of course, these insurance offer the benefits they claim. So, if you want to take them, go for it. But, if you don't, don't let the bank force it on you.

My 2 cents

Most of the foreigners buying a house in Germany have good secure jobs. So, the probability of losing a job is low. Hence, I don't prefer to take this insurance.

On the other hand, you cannot plan events like death or accidents. So, consider the impact on the financial well-being of your family in such an event.

For example, suppose you and your wife have good jobs and salaries. Then, if one of you is unable to work or dies, the other can take care of the family expenses and mortgage installments. Thus, you may decide to opt-out of this insurance.

On the other hand, you are the only breadwinner in the family. Then, I recommend considering such insurance.

5. Taking high monthly installments

Always try to take a lower monthly installment for the following reasons.

Low monthly installments result in positive cash flow if you rent the property.

You can deduct the interest paid from your taxes. So, the slower you repay the mortgage, the more interest you can deduct from your taxes.

The low monthly installment has a lower impact on your monthly budget.

When interest rates are lower than inflation (i.e., 2020 - 2022), repaying the mortgage as slowly as possible is beneficial for the borrower. The reason is that the value of the mortgage amount is reducing with time due to inflation.

You must be wondering how to calculate the minimum monthly installment.

How to calculate the minimum monthly installment?

Here's a rule of thumb for calculating the minimum monthly installment.

Minimum percentage of amount to repay per annum (MPA) = 100 / (Retirement age - Your age)

Minimum monthly installment = (((MPA + Interest rate) / 100 ) x Purchase price) / 12

How did I come up with this formula?

For banks, you must be able to repay the loan before retirement. Thus, banks first check how many years you have before retirement.

Then divide 100 by the number of years before retirement. Finally, it gives the minimum percentage of the amount you must repay per annum.

Here we took the number "100" as we want to repay 100% loan before retirement.

For example, your age is 30, and your retirement age in Germany is 65. Thus, you can work (65 - 30) 35 years before retirement.

This means you must repay at least a 3% mortgage each year (100 / 35 = 2,85 or 3% approx.)

So, you must repay at least a 3% mortgage principal plus interest yearly. Suppose the mortgage interest is 2%, then you pay at least 5% (3% + 2%) of the loan amount per year.

Now, calculate the amount you must repay per annum using the minimum percentage you calculated in the previous step.

Suppose you took a mortgage of 300k €. In this case, the minimum amount you must repay each year is 5% of 300k, i.e., 15k €.

Lastly, in this example, the minimum monthly installment will be 15k / 12 (Number of months in a year) = 1250 €.

When does taking a high monthly installment beneficial?

When the interest rate is higher than inflation, the mortgage's value increases with time. In this situation, it is better to repay the mortgage early.

What can you do about it?

Instead of taking high monthly installments, take the option of "special repayment (Sondertilgung)."

Under the "special repayment" option, you can repay 3% to 5% of the mortgage principal annually on top of monthly installments.

The best part of the "special repayment" option is it's optional, and you don't pay interest or penalties while repaying the mortgage.

You can learn more about it here.

6. Not negotiating the mortgage terms with the banks in Germany

Do you feel uncomfortable negotiating mortgage terms and conditions with the bank? Well, you are not alone. Many people have this feeling.

But, by negotiating the mortgage terms, you can save thousands of euros.

Just ask banks questions and the different options available. Don't consider it negotiation, but information gathering.

In short, step out of your comfort zone and negotiate the mortgage terms like interest rate, monthly installment, special repayment option, insurance, etc.

How can you negotiate a mortgage offer?

The simplest way to negotiate a mortgage offer is by talking to several banks and brokers. Then, bid different banks against each other to get the best offer.

In the end

Ask questions to your bank consultant and educate yourself on various mortgage terms. You can save thousands of euros by being aware of these mistakes.

I wish you all the best on your journey to buy a house in Germany.

![Mortgage in Germany [2024 Expats Guide]](https://static.wixstatic.com/media/b197ce_38df428941d64e8f8ab1ef62e97d6de8~mv2.jpg/v1/fill/w_980,h_654,al_c,q_85,usm_0.66_1.00_0.01,enc_avif,quality_auto/b197ce_38df428941d64e8f8ab1ef62e97d6de8~mv2.jpg)

![Buying House in Germany [2024 English Guide for Foreigners]](https://static.wixstatic.com/media/b197ce_00b54e9cf8f3478c91aeea4fa977ace3~mv2.jpg/v1/fill/w_980,h_545,al_c,q_85,usm_0.66_1.00_0.01,enc_avif,quality_auto/b197ce_00b54e9cf8f3478c91aeea4fa977ace3~mv2.jpg)